Post Preview

Table of Contents

- Introduction to Payment Security and Fraud Prevention

- Understanding the Complexity of Financial Fraud

- The Role of Compliance Managers and Auditors in Fraud Detection

- Technology’s Hand in Fortifying Payment Systems

- The Human Factor in Payment Security

- Legal and Regulatory Aspects of Payment Security

- Future Trends in Payment Security and Fraud Detection

- Conclusion: The Continuous Journey of Payment Security Enhancement

Key Takeaways

- Fostering an in-depth understanding of contemporary financial fraud and its consequences.

- The critical function of compliance managers and auditors in fraud deterrence.

- Embracing technology as a key ally in developing more secure payment systems.

- Highlighting the human aspect and corporate culture’s influence on payment security.

- Anticipating future trends and preparing for ongoing threats to payment security

Introduction to Payment Security and Fraud Prevention

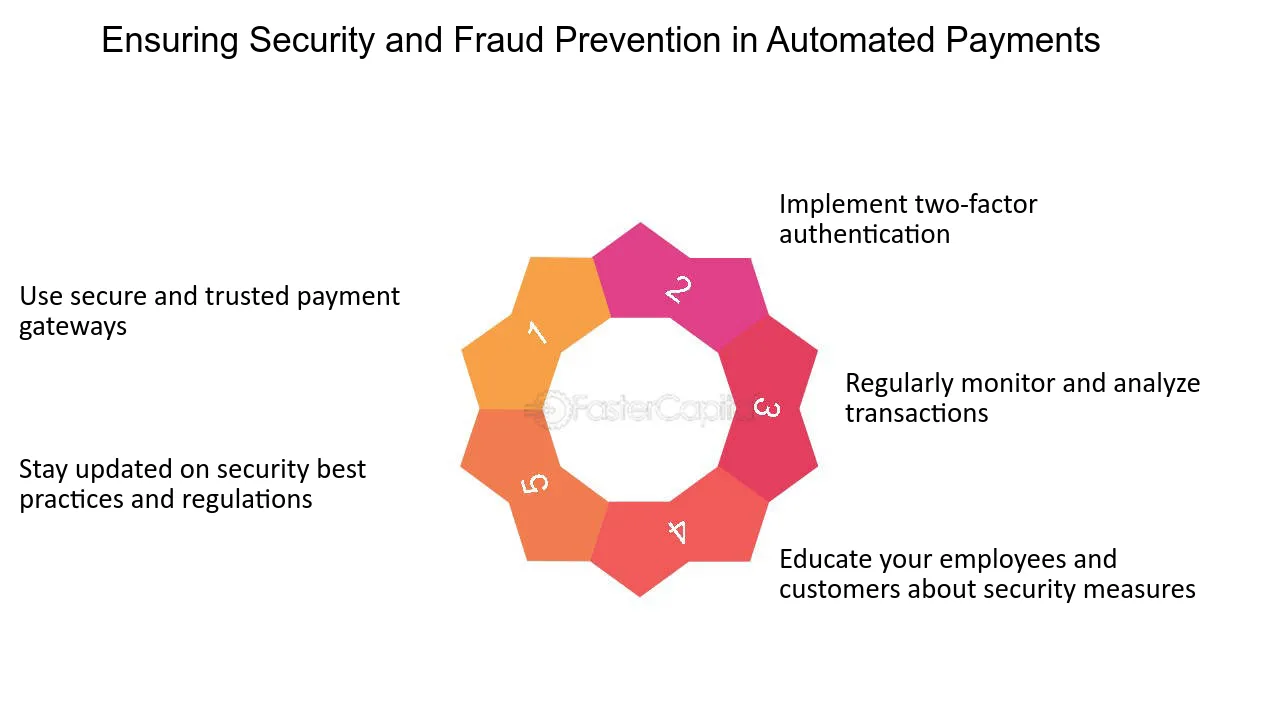

In today’s digital-first economy, payment security is one of the top priorities for businesses worldwide. Although online transactions are easy and convenient, they also come with the risk of fraudulent activities that can harm the financial well-being of both companies and consumers. Understanding and implementing effective online payment fraud prevention strategies is crucial to address this issue. Constant vigilance and a multifaceted approach to identifying and mitigating risks are necessary to ensure the integrity of payment systems.

Understanding the Complexity of Financial Fraud

With the rise of digitalization, payment processes have become more convenient, but it has also opened the door for financial fraudsters. Various examples of financial fraud include identity theft, account takeover, card skimming, and phishing schemes. Criminals continually develop new methods to exploit payment infrastructure vulnerabilities, and these tactics evolve as technology advances. Therefore, businesses and consumers must stay vigilant against emerging threats.

Moreover, the impact of online payment fraud prevention goes beyond just monetary loss. It can disrupt business operations, erode customer loyalty, result in legal entanglements, and cause long-term damage to a company’s financial health. For consumers, becoming a fraud victim can compromise their privacy, deplete their funds, and lead to an extended battle to recover their financial stability. Therefore, it’s essential to implement a comprehensive strategy that focuses on transaction security and balances user convenience and confidence. This strategy should include measures for online payment fraud prevention and must be regularly updated to counteract new threats as they develop.

The Role of Compliance Managers and Auditors in Fraud Detection

Compliance managers and auditors are entrusted with a mission-critical task: ensuring the safety and reliability of financial transactions. They set the standard for due diligence, employing comprehensive audits, risk assessments, and monitoring protocols. Vigilant oversight helps to unearth suspect activities, and well-crafted internal controls act as a bulwark against fraudulent transactions. However, beyond the reactive mechanisms of identifying and responding to fraud, they are also responsible for fostering a proactive environment where security measures are ingrained within the organization’s fabric.

Regarding nipping fraud in the bud, proactive fraud prevention is the hallmark of savvy businesses. Companies can significantly reduce the likelihood of fraudulent attacks by investing in the latest fraud detection software, engaging in regular training, and cultivating an atmosphere of security-consciousness. These endeavors must be continuously refined to adapt to the volatile nature of financial fraud. This task calls for ongoing education, assessment, and the implementation of refined tactics to stay ahead of sophisticated fraudsters.

Technology’s Hand in Fortifying Payment Systems

Technology is invaluable in the quest to stay one step ahead of criminals. Machine learning algorithm, for instance, have shown exceptional promise in identifying anomalous behaviors and patterns indicative of fraud. Beyond traditional rule-based systems, these intelligent platforms can sift through massive volumes of data in real-time, pinpointing inconsistencies that might allude to fraudulent activity. Institutions relying on constantly refining such innovative tools establish themselves as formidable opponents to cybercriminal activities.

Organizations incorporating sophisticated technology into their anti-fraud strategies enhance security measures and streamline the payment process. This can improve customer satisfaction as transactions become swifter and smoother while maintaining rigorous security protocols. Embracing technological solutions also alleviates the weighty task of security management from human shoulders, minimizing errors and allowing fraud prevention teams to concentrate on complex cases that demand human intervention.

The Human Factor in Payment Security

The most sophisticated security systems can still be compromised by human error. Consequently, a robust security protocol must include a comprehensive training and awareness initiative. Such programs educate employees about the latest fraud prevention strategies and instill a sense of responsibility and alertness regarding security best practices. By ensuring that all staff members are aware of the potential risks and understand how their actions can influence security, businesses erect an additional layer of defense against fraudsters.

Establishing a culture rooted in security-mindedness begins with leadership. Executives must affirm the importance of security within corporate doctrine, pushing for policies and actions that reflect an unwavering commitment to defensive measures. A workplace where every team member feels involved in and accountable for the security of company assets can transform the organization into a hostile environment for those with ill intent.

Legal and Regulatory Aspects of Payment Security

Businesses must follow numerous laws and regulations to guarantee secure payment systems. Following standards like PCI DSS and GDPR helps companies to comply with legal obligations. It assures customers that their data is safe. But beyond compliance, a deep understanding of these regulations provides a blueprint for developing internal policies that reinforce trust and safeguard assets.

Future Trends in Payment Security and Fraud Detection

The realm of payment security is dynamic. Technological leaps, regulatory shifts, and the evolving database of cyber threats point toward a horizon of unceasing change. Staying informed through governmental and industry resources equips businesses with the foresight to effectively anticipate and counter future fraud threats. By doing so, they secure their position in the vanguard of payment security and set the standard for others to follow.

Conclusion: The Continuous Journey of Payment Security Enhancement

Pursuing robust payment security is a continuous endeavor that demands vigilance, agility, and a steadfast commitment to innovation. As cybercriminals refine their tactics, businesses must correspondingly bolster their defenses. It is an ongoing armament race where diligence, cutting-edge technology, and informed strategies form the bulwark against those who would harm. By linksoars remaining proactive and responsive, businesses can offer a secure haven for financial transactions and foster enduring trust with those they serve.