Ever wondered how you can financially protect your loved ones in case of an unfortunate event? Life is full of uncertainties, and it’s crucial to plan for the unexpected. This is where term plans come into play. A term plan is the purest form of life insurance that provides financial security to your family at an affordable cost. In this article, we will explore the various benefits and features of term plans, helping you make an informed decision about securing your family’s future.

Term plans as affordable protection for your loved ones

One of the most significant advantages of a term plan is its affordability. Unlike other life insurance products like whole life plans or unit-linked insurance plans, a term plan offers pure life cover for a specified amount (sum assured) and tenure (policy term). If the policyholder passes away during the policy term, the life insurance company pays a death benefit to the nominee. However, there is no maturity benefit if the insured survives the policy term.

The simplicity of a term plan makes it an affordable option as insurers only have to pay out in case of a death claim. The premium for a term plan is significantly cheaper compared to other life insurance products. It comprises mortality charges and basic administration costs for policy issuance. Purchasing a term plan is an essential step in financial planning as it protects your family from debt or loans, ensuring their quality of living remains intact.

Easy and convenient process of term plans

Buying a term plan is now easier than ever. Just like purchasing clothes or household items online, you can buy a term plan with a few clicks over the internet. The process of buying a term plan is straightforward and doesn’t require extensive market knowledge or expertise.

There are two ways to purchase a term insurance policy: offline and online. Offline buying involves going through an insurance intermediary like a broker or agent. On the other hand, online buying allows you to directly purchase from the insurance company through their website. Online term plans are not only cheaper than offline plans but also offer quick processing without any physical documentation hassles.

Term plan with return of premiums

Some individuals hesitate to invest in pure-term plans as they do not offer maturity value if the insured survives the policy term. However, there is another variant called “term plan with return of premiums” (TROP) that offers maturity value equivalent to the return of all paid premiums if the insured survives the policy term. Although TROPs are slightly more expensive than normal term plans, they provide both death and maturity benefits (whichever occurs first).

Analogy:

Think of a term plan with a return of premiums like renting a house. When you rent a house, at the end of the lease period, you don’t get any monetary returns. However, with TROP, it’s like getting your rent back if you survive the lease period. This variant offers an additional benefit for those who want to have some form of maturity value along with life cover.

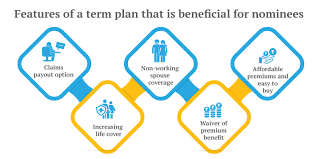

Staggered claims payout option

In some cases, receiving a lump sum claim amount might pose challenges for the family members managing it. To overcome this, term plans offer a staggered claims payout option. This means that instead of receiving the entire claim amount in one go, the beneficiary can choose to receive a partial amount as a lump sum and the remaining amount as monthly or yearly income.

Partial lump sum payment helps the family deal with immediate financial crises while the staggered payout provides a regular source of income to cover monthly expenses. The flexibility to choose between lump sum and staggered payouts gives families more control over how they manage their finances during difficult times.

Term plans: Flexible premium payment options

Term plans offer flexibility in paying premiums according to your financial situation and convenience. You can choose to pay premiums annually, semi-annually, quarterly, or even monthly. Additionally, some plans offer single pay or limited pay premium options apart from regular pay premiums. Take the help of a term plan calculator to have a clear idea of the premiums you have to pay while buying a policy.

The ability to choose premium payment frequency and mode allows policyholders to align their premium payments with their budgetary requirements. It ensures that individuals can sustain their insurance coverage without straining their finances.

Additional benefits and rebates

Term plans come with additional benefits and rebates to make them even more attractive. Insurance companies offer rebates for opting for higher sum assured amounts under term plans. Non-smokers and female lives also enjoy special discounted premium rates as they are considered “standard lives” with no adverse risk associated with them.

These additional benefits and rebates make term plans more accessible and affordable, encouraging individuals to secure their family’s financial future without breaking the bank.

Conclusion

Term plans provide an affordable and effective way to secure your family’s financial future. By understanding the various features and benefits of term plans, you can make an informed decision that suits your budget and financial goals. Remember, purchasing a term plan is the first step towards financial planning and ensuring your loved ones are protected in case of any unfortunate events. So, explore Luv.trise options, and use the term plan calculator provided by trusted insurance providers.